Tag Archive for ‘culture’

Are we always going to spend countless hours on planes to get to sit in meeting rooms with colleagues?

This morning, as I sit on yet another flight, this time from Singapore to Hong Kong, it’s ever more apparent to me that far from video conferencing and other forms of communication taking the place of international travel, planes are fuller than ever with business travellers flying short distances for a schedule of meetings, which from my own straw poll over the past 18 months, are mostly internal to their […]

I’m working on a couple of transactions at the moment and was reminded recently again of the critical role that an exiting CEO can play in smoothing the path of a deal, often at its most important phase, in the post merger integration. For those of you who have been involved in M&A, you will recognise the quintessential challenge which an acquirer faces in dealing with this individual. The facts are relatively straightforward:

- He / she will be one of the first casualties of the deal. Typically given the nature of the deal marketplace, the new CEO is appointed by the acquirer and rarely comes from the acquired business.

- Financially, the exiting CEO will be looked after…either through a short-term retention package or through a settlement around redundancy, giving him / her the relative freedom to make some personal decisions about what to do next.

Accepting this as the status quo is in my opinion a mistake, particularly in cases where the CEO concerned has played a key role in the development of the business, leading to its sale and continues to be valued by the employee base. He is likely to have been involved in the hiring, mentoring, and career development of key people, notably his / her direct reports, who will be important in the integration process. He / she will have had an impact on the culture of the organisation in the way that decisions are made, where autonomy sits in the corporate hierarchy, what level of risk appetite exists and perhaps in the flow of information around the business. He / she will have had a role to play in the informal organisational structure, where the key influencers sit and how they interact. Now, without doubt, having him / her around can be more than awkward for the incoming CEO. There is the potential for a disruptive influence, for a lack of clarity around who the ultimate decision maker is, perhaps even for the creation of some kind of corporate terrorist who will actively undermine the new direction of the business. There is also the possibility that he / she does not want to be involved in the next stage of the company’s development. Clearly these are all unacceptable and need to be dealt with quickly. However, let me create an alternative scenario. Let’s consider the role that this person could play given their unusual position in the merging organisation and with the appropriate good will:

- An initial engagement between announcement and completion which focuses purely on the prevention of value destruction…retention of key individuals, strong and well directed communication around the transaction as much as that is possible, engagement of the key customers maintaining service standards and relationship management during a disruptive period. In fact, in my experience this period has significant potential for major value destruction as the attention and focus of key people drifts to the prospects of their immediate future.

- A role around Day 1 and for the first 100 days which is as chief communicator and translator / interlocutor for the acquired employee base, using that trust, those relationships and that intimate knowledge of how the business works to create some stability in the critical initial period. I’ve worked on several transactions where the exiting CEO used his influence to translate the requirements and expectations of the acquirer to his workforce, giving an understanding of culture and work processes which removed the emotion from the deal.

- An adviser to the integration steering committee, to be used as necessary to comment on and provide insight on direction, plans and key initial activities.

And in return for these important actions, a compensation structure which is firmly linked to some initial KPIs around key employee and customer novation / retention, effectiveness of communication flows, and perhaps stability of revenue / cost post completion. I read in the FT and indeed many of my colleagues are suggesting that there is an upturn again in the deal volume being experienced. Having spent 14 years consulting in this arena, it would be great if we could finally move away from the cycle of value destruction and find some new solutions to an old problem. Using the insight, relationships and knowledge of an exiting CEO might be a small step in the right direction.

Bringing project management into the mainstream

With thanks for an excellent seminar last night by Thomas Martin of Forward Intelligence Group and previously Microsoft, and also a reflection from a number of other clients and colleagues, I’ve been observing an interesting series of phenomena in the last few months. A redrawing of some of the traditional boundaries between transformation and business as usual activities, specifically when it comes to allocation of CAPEX. It seems that there […]

Working from home….management’s last bastion of control

The nature of the office workplace has changed almost beyond recognition in the last 30 years. The pace of change in terms of activity, responsibility, speed of communication, access to information and people, and complexity of the ‘transaction’ whatever the company might be engaged in, are all vastly different. Gone are vast numbers of manual tasks and with them activities and roles in the workplace. What is required these days […]

Compensation structures – still stuck in the dark ages

As I get older and the needs of my family change, the inherent inefficiency of traditional reward structures becomes more and more obvious. What I mean simply is that the requirements I had of both salary and benefits when I was 20 or 30 are no longer relevant to me, indeed more importantly than their practical purpose is the reduced perceived value that they offer. Much has been written and […]

Glass half full; glass half empty – review of 2013 and a view of what 2014 might hold in store for us

Pcubed : Insight : Insight #1 :. Some interesting, personal, observations from a conversation with Sim Preston of AIA. He gives some very powerful perspectives in terms of the upside and downside for 2014. Definitely work a read.

You Can’t Pursue Happiness if You are Sitting Still

You Can't Pursue Happiness if You are Sitting Still. The headline of this blog is a little misleading…however the contents are interesting, not only because of the fact that I have a teenager, but also because there seems to be an increasing discussion around the subject…Craig Ferguson’s diatribe on the Late Late Show is a good example. Worth a read.

Rights and obligations in the corporate world

I’ve been on a few flights this week and beyond catching up with my favourite shows on the BBC iPlayer (!), the article penned by Malcolm Henry which I reposted last week, seems to be having a disturbing effect on me! Malcolm was describing the debate in Scotland as to the establishment of a bill of rights and his proposition that a bill of obligations would be much more powerful. […]

Rights Or Obligations: Which Is It Going To Be, Scotland?

Rights Or Obligations: Which Is It Going To Be, Scotland?. This comes from a blogger whom I’ve been following around his observations around Scottish independence. However the application of a bill of obligations / as opposed to rights has the potential for application in a corporate environment as well. An interesting concept for future change management initiatives?

The only thing that matters in running a consultancy

As I reached an interesting milestone in the build of my consultancy in Asia last month, I had a moment to think about what it was that I was actually in control of. Not the stuff that you tell your shareholders, or your boss, or your colleagues or indeed your husband / wife…but the reality. And it struck me in a second of starting simplicity. The only thing I can […]

Moving from Subject Matter Expert to Consultant

Two interesting moments this week: I was asked by a client to work with his team to help them understand what it is to become consultants. Interesting mandate and many might say, why on earth would you want to do that? A powerful debate with a fellow consultant around the challenge behind being both a subject matter expert and a consultant. In preparing something for the first of these challenges, […]

Consulting language…who comes up with these expressions!

Many years ago when I first started consulting, my wife said to me, “make sure you continue to speak English, if its your single contribution to your profession that you do this, it will have been a career worth having!” It’s an extraordinary thing that we seem to delight in, coming up with language which is so nebulous as if the sole purpose is to confuse rather than clarify! Maybe […]

People versus Process

At the risk of antagonising a number of my close colleagues and friends who work with me currently or with whom I’ve had the pleasure of working in the past, I wanted to ask a challenging question. In 14 years of working with companies going through a post-acquisition integration process, there’s been an outstanding issue which to my mind has never been answered properly – Why is it that process […]

For those of you who’ve read the ‘Hard and Soft’ blog, I wanted to return to a theme which has been crucial in my 14 years of consulting…culture.

Throughout this blog, you will find cultural barriers manifesting themselves as specific, definable issues which have specific definable solutions. This is a significant change from 10 years ago in terms of the level of recognition amongst board members. The reasons have probably a lot to do with the growth in cross-border activities, where cultural difference is relatively easy to observe, and in many cases, a growing awareness of people-related challenges in the boardroom.

This development is also reflected in board room appointments. Appointments at board level with titles like ‘Head of Organisational Development (OD)’, ‘Director, OD and Change’, are becoming more frequent and reflect a separation of these set of responsibilities from its traditional, if sometimes reluctant owner – HR. Dave Ulrich also implicitly acknowledges this when he talks about a move amongst HR leaders who now need to take up more of a strategic role within their organisations.

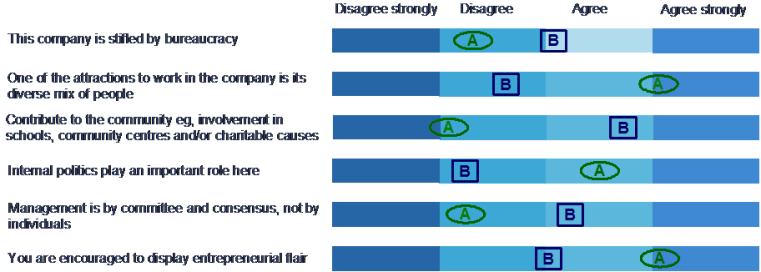

An interesting example of cultural change in a post merger integration project occurred in a transaction involving two retailers in Europe, spanning a number of countries but with a large base in the UK. In this case, the cultural barrier lay between two extremely well-aligned businesses – in other words, in the eyes of the employees, there was a strong linkage between the values which they themselves held and those of the business in which they worked. The potential was there for a very explosive situation as the businesses were significantly different in their approach. To give you some examples of the key difference, I’ve set out above some of the dimensions which we used to measure this difference. In each case, we asked the individuals we interviewed to mark on the spectrum where they saw their organisation (annotated as A and B). Some of the more startling results are seen in the graphic above.

What was fascinating was in certain dimensions where an external party might have seen an issue, for example ‘internal politics play an important role here’ or ‘the company is stifled by bureaucracy’, the individuals on the other hand, saw these as positive traits. ‘Internal politics’ were attributed to a management style which saw influence as a critical tool for changes to take place. In the case of ‘bureaucracy’, individuals considered that to be a key element in the collaborative and consultative nature of the business.

Another interesting result showing up the disparity between the two cultures was the question concerning entrepreneurial flair. For one organisation, this reflected a high degree of comfort with ‘ownership’ – many of the senior and middle management team had been owners of businesses which had been acquired by the company. Their willingness to take risks was based on that experience. For the other company, risk was seen as difficult and unattractive as the impact on the brand was unknown and potentially dangerous.

If these differences had not been addressed, the potential damage to the integration from a productivity perspective would have been very substantial.

The solutions in this case were fourfold:

1) The diagnostic (which had been conducted to get the above results) was communicated to a very broad audience, from executive board to each workstream. In each case, certain decisions were made around the operational implications of the different approaches. For example, at integration team level, agreement was reached on the level of consultation required for decisions. This was critical because the business needed to respond quickly and efficiently – individuals were asked to place themselves in various categories of ‘need to know’, which forced them to realise the nature of their role in the process of decision making. It also created an environment where ‘doing’ first and asking for forgiveness later was acceptable.

The process of releasing the information was in itself a solution. It provided employees at all levels with a sense of the leadership style going forward, and started to develop some trust.

2) The language used in the diagnostic was put into a corporate directory and distributed widely. For both technical and non-technical terms, there had been increasing levels of confusion about what each party meant when they used certain expressions and this helped to clarify. However, from a cultural perspective, certain terms became very helpful, non-pejorative descriptions of behaviour which employees from both businesses used and understood. At a board meeting a year later, the Finance Director used a couple of expressions directly from the diagnostic to explain certain performance characteristics – the fact that this language had transcended into financial management analysis on his part was very powerful for the organisation.

3) The diagnostic informed the process for developing senior executive long term incentive plans. Previously these plans had been created for a relatively small group of people whose interests were aligned. The process of broadening the schemes to have an impact on a group 3 or 4 times the size of the previous structure reflected a new culture within both businesses – one of personal accountability. Not only that, it also created the need for a more formal collaboration and alignment requirement in the combined business which was very important.

4) Finally, the attitude towards innovation and risk also changed considerably. This followed the successful launch of a new product which generated an exceptional return for the newly merged business. As the positive publicity surrounding this product increased internally and externally, a new found confidence towards developing ideas started to surface, and the perceived risk of entrepreneurial behaviour began to diminish.

To summarise, culture remains the key buzz word around transformation and post merger integration. How it is defined, its impact on successful implementation and on some of the solutions – all these aspects are becoming much more commonplace concepts amongst senior management. Ultimately however, there are still some considerable hurdles to deal with, before organisations see the ultimate value arising from culture-related activities.

The first hurdle is that diagnostic alone (particularly e-based diagnostic which has little human interaction) is interesting in a kind of ‘navel-gazing’ way but it needs more than that to make change happen…self-awareness through someone putting a mirror in front of you is a powerful thing, but there needs to be some clarity about what the future looks like. If you’re interested, you can read more about this in ‘To diagnose or not to diagnose’ on this blog.

The second hurdle is alignment. Part of any business strategy around major change or transformation is the need to include alignment – ask yourself these: how does my reward strategy reflect the performance I need from my senior management; does my induction programme deliver key messages at the start of a person’s employment which are aligned to the overall strategy; do the communication channels in themselves reflect how we, as a business, should be engaging with our employees and customers? Alignment challenges exist right across the board and the more aligned you can be, the greater the level of commitment, productivity and the retention of key staff you will achieve.

Finally, culture change and transformation / integration are about creating role models and myths or legends within the organisation. The power of a story compared with a mission statement is much more compelling, particularly if the story is related to an individual whom people have met or had opportunities to interact with. As an example, I have no doubt that the only things any reader of this blog might remember in a month might be some of the selected stories – and if so, it would be an achievement on my part.

Culture in transformation…the (not so) new kid on the change management block

IP in consultancies…an interesting and current angle

I only wish I was accurate with my investments as with the timing of material in my blog! Below is a link to an article in the FT regarding the potential sale of Roland Berger, a mid sized strategy consultancy to PwC…it raises a bunch of very interesting integration issues…to do with the sale of a business whose only value is in its human capital. Potential value destruction disaster!!

Giving stuff away – the false value of intellectual property

Selling a consultancy is challenging and often not very financially rewarding. I’ve done it a couple of times and what looks like a great opportunity to generate some return for all the effort, is incredibly hard work and often not very lucrative. When you talk to advisers, they will talk about intellectual property a lot. A classic question would be, “what have you got which a buyer might be able […]

China into Europe

At the risk of promoting my old employer, they’ve just written an interesting piece on Chinese M&A into Europe…PricewaterhouseCoopers….worth checking out

Hard and soft

Talk about the most pejorative of terms you’re ever likely to come across! Traditional corporate culture would have you believe that ‘hard’ things are factual, financial, real, rational. ‘Soft’ things are woolly, emotional, irrational, hard to prove, based on feelings and impressions rather than hard evidence. Soft things are easily manipulated, they’re the domain of the HR function, we’ll pay lip service to them but the real decisions get made […]